State of Polkadot

Q3 2024

Last updated: 20.08.2024

Author: Amir A. Ulrik L.

Executive Summary

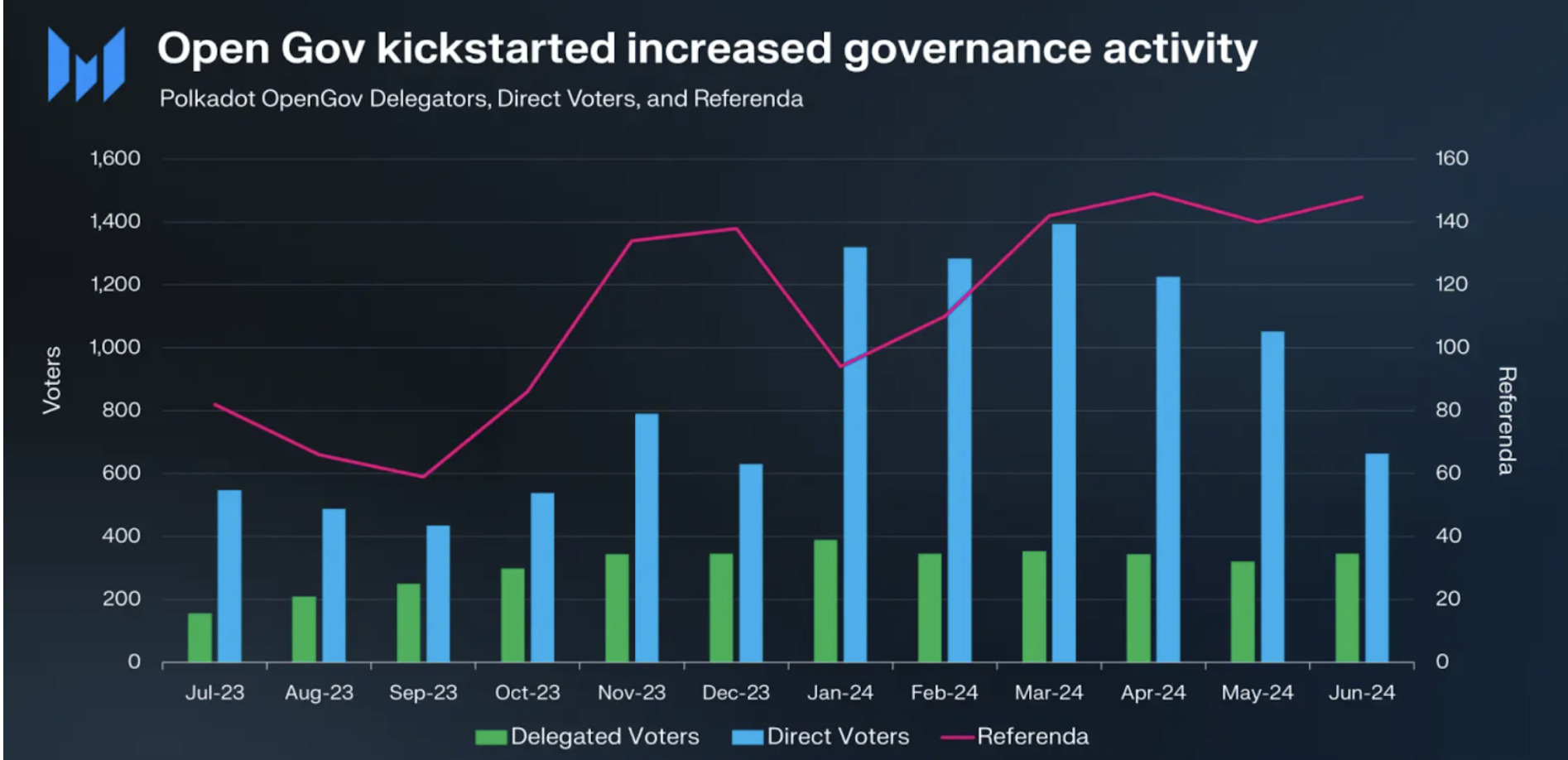

- The launch of OpenGov has positively resulted in more active participation of the community in governance.

- Polkadot 2.0 is on the verge of being fully implemented, turning Polkadot into a network that offers computation and security infrastructure for projects.

- Treasury expenditures have significantly increased in 2024. Continuing the outflow rate seen in 2024 will result the depletion of Polkadot’s treasury within the next 15 months.

- Onchain activity across the ecosystem has grown modestly throughout the year, but still remains below expectations for a project aiming to build one of the largest blockchain ecosystems.

- Notable new parachains are EnergyWeb, which migrated from their EVM-based chain to Polkadot, and Manta that launch its own parachain.

- Developer activity across the ecosystem is declining, however, Polkadot still has the second largest developer base. Polkadot has also taken numerous initiatives throughout the last year to attract developers to build on their ecosystem.

- Following Polkadot 2.0, the JAM upgrade be implemented radically changing the network. This update raises doubts that the current model Polkadot have built has not succeeded as intended. As this update is likely 2 or more years, the success of Polkadot 2.0 to drive meaningful adoption to the chain will likely be a key factor in DOT’s price performance over the next couple years.

Network updates

The launch of OpenGov on Polkadot, implemented in June 2023, significantly revamped the network's governance model. Unlike the previous system, which involved a council and technical committee making key decisions, OpenGov introduced a fully decentralized and transparent process where any DOT holder can propose or vote on changes. As shown below, OpenGOV has gradually gained more traction since launching in terms of voting activity. We construe the increased participation as positive for the network.

Source: Messari

Long Awaited Polkadot 2.0

Polkadot 2.0 has not been fully implemented as of now; instead, key components of the upgrade have been rolled out gradually. While features like Asynchronous Backing, Snowbridge, and Elastic Scaling have significantly enhanced the network, the full vision of Polkadot 2.0 is still to be harvested. Critically, while these upgrades have brought tangible improvements, the rollout has faced challenges. The complexity of implementing such advanced features has led to significant delays and incremental releases, which may have dampened some of the initial excitement. Additionally, while the introduction of tools like Polkadot Play and the deployment of stablecoins are positive steps, broader adoption and real-world use cases are still developing. In terms of living up to the hype, Polkadot 2.0 has made notable strides, but the full potential of these upgrades is yet to be realized. The success of Polkadot 2.0 will depend on how effectively the network can continue to deliver on its promises, attract developers, and drive meaningful adoption in a competitive blockchain landscape.

Ecosystem initiatives

- Polkadot Alpha program launched to provide direct support developers building on Polkadot

- Polkadot Blockchain Academy: a course for developers teaching how to build blockchains on Polkadot (using XCM and the Polkadot-SDK)

- Decentralized futures program: 20m USD and 5m DOT for individuals and teams launching initiatives aimed at growing the Polkadot ecosystem.

- Launch of Jam prize fund: $60m in prizes for developers that are able to complete milestones related to the development and implementation of JAM

Treasury Updates

Current treasury: 26.03M DOT and $7.7M USDT/USDC equalling roughly $124.8M at Polkadot’s current price.

Treasury inflows:

The primary source of income for the treasury comes form supply inflation. The other revenue source is network fees. However, with only $41K raised this year from fees, this figure is negligible.

During the first 7 months of this year, 5.4M DOT tokens have been added to the treasury, which is significantly less than the expenditures highlighted below.

Current usage and runway

Polkadot has used up a sizable amount of its treasury for marketing and other purposes this year: By the end of June, $86M was used. $36M of this went towards marketing, conference hosting, and other PR-related activities. The next largest attribution to the cost base was software development at $26M.

In total the 20.8M DOT has been used from the treasury as of the beginning of August. At the rate of inflows and outflows seen this year, Polkadot’s treasury is experiencing an average monthly outflow of 2.18M DOT. Sources online estimate around 2 years of runway but following our calculations, we estimate the treasury runway would be closer to 15 months from today’s date.

Onchain Activity

Onchain activity in terms of transaction count and active addresses across parachains have experienced some growth since October 2023, however, this has slowed down in recent months.

Relay chain activity

Source: Messari

Note: The sharp spike in activity during January 2024 occurred due to trading of inscriptions on Polkadot

Daily XCM messages

Source: Subscan.io

XCM messages follow a similar trend to address activity.

Parachain to parachain messages: apart from some spikes, parachain to parachain messages have been steady throughout the year.

Source: Messari

Leading Parachains by active addresses

Source: Messari

- Nodle, Moonbeam, and Manta are leading parachains by addresses

- Moonbeam actively runs quests/mission campaigns, which perhaps explains their high number of active addresses

- Nodle is a mobile depin network with a substantial amount of users

Leading Parachains by daily transactions

Source: Messari

Onchain Total Value Locked of Leading Parachains

Polkadot’s initial ‘big 3’ Parachains Moonbeam, Astar and Acala continue to struggle in attracting liquidity onto their chains. Apart from Bifrost that has seen a substantial growth in TVL since the end of the first Parachain leases, no Parachain has successfully attracted substantial TVL.

Moonbeam TVL

Source: Defillama

Astar TVL

Source: Defillama

Acala TVL

Source: Defillama

Manta TVL: Manta’s TVL experienced significant growth as it was incentivised. Since the token airdrop occurred, the TVL decreased drastically.

Source: Defillama

Bifrost TVL: increasing TVL shows a growing demand for staking, coinciding with the end of Polkadot’s first wave of Parachain auctions.

Source: Defillama

Notable Parachain Movements

Notable new parachains

- Energy Web migrates from their EVM based chain to adopting a Parachain.

- Manta launched its Polkadot Parachain.

Upcoming parachains

- Sora: non-debt based monetary framework built to enable economic monetary stability for financially vulnerable countries.

- Mandala: a blockchain aiming to provide infrastructure for governments and enterprises looking to build retail applications.

- Hyperbridge: an interoperability protocol that uses Polkadot as its base layer where proofs are submitted on. Hyperbridge aims to be a trustless bridge between Polkadot and all chains.

Developer activity

According to Electric Capital, Polkadot ranked 2nd in 2023 in developer activity. Although the activity is high relative to other blockchain, weekly commits have been declining substantially since Q1 2023. Although the decline is concerning, data from Artemis shows that this decline in weekly commits is happening with other highly ranked Layer 1 protocols in the market.

As early projects in Polkadot received substantial funding, further analysis into which projects are contributing towards the developer activity would provide useful insight to the portion of activity that is reliant on funding received during the early stages of Parachains.

Note that the data gathered from Artemis below takes into account any project loosely building within the Polkadot ecosystem, meaning projects such as Wormhole, Uniswap, Pyth, and others are included in the data.

Weekly commits

Weekly active developers

Source: Artemis

Future updates

Polkadot 2.0

Most of the upgrades of Polkadot 2.0 have already been set in place. The remaining updates are the implementation of Coretime and Blockspace, which will shift Polkadot from the current auction and leasing system to a more flexible system enabling short-term leases or even a pay-as-you-go option. This will transform Polkadot into a network that offers computation and security infrastructure for projects.

Polkadot JAM upgrade (Polkadot 3.0)

JAM is a radical change going from Webassembly to Polkadot Virtual Machine. This update aims to drastically boost performance and efficiency and fundamentally change Polkadot by turning the Relay Chain into a general purpose chain capable of hosting smart contracts, parachains, and native zk-rollups.

The key reason behind this upgrade is to enable more seamless interoperability than what has been achieved through Parachains and XCM, indicating a lack of satisfaction with what has already been built. The update is still in its very early stages and is expected to be implemented in 2 years.

Where is Polkadot headed?

Throughout the last year, Polkadot has taken numerous initiatives to boost their ecosystem. Notably USDC and USDT have been adopted in the ecosystem. Polkadot has also started numerous grants and programs with an aim to attract developers to build in their ecosystem. Furthermore, significant capital has been spent on marketing and PR in the first half of 2024, however, this has not positively reflected in the price of the token. Furthermore, the current expenditure rate raises concerns that the treasury may soon be depleted.

On-chain activity on Polkadot and its Parachains have experienced some growth since October 2023, however, the adoption of the ecosystem is still disappointing for a project aiming to become the premier destination for Layer 1 blockchains to join.

The Polkadot 2.0 update, transitions Polkadot from a long-term Parachain leasing model to a network that offers computation and security infrastructure for blockchains with flexible payment options (short-term leases or pay-as-you-go).

With an increasing number of competitors in Layer 1 infrastructure such as Polygon 2.0, Avalanche subnets, Arbitrum Layer 3s, and ZKsync Layer 3s, Polkadot now differentiates itself as the only project offering security and computation resources on a short-term and flexible basis.

Following the implementation of Polkadot 2.0, Polkadot plans on implementing JAM, an update that will radically change the network. Although this pivot could fundamentally improve the network, it is still a couple years away, which may be too late in a rapidly evolving market. Furthermore, this pivot raises concerns that what has already been built has failed to achieve the vision that Polkadot initially aimed for. Furthermore, the fast rate at which the treasury is being depleted so far this year, raises concerns regarding the planned timeline to implement JAM.

Considering the adoption of the ecosystem and the numerous initiatives taken by the Polkadot foundation, it feels as if the success of Polkadot 2.0 is a make or break moment that will play a crucial role in determining the Polkadot network’s native token DOT to appreciate in price over the next couple years.

Disclaimer

The information presented in this report is for informational and educational purposes only and should not be construed as investment advice, financial guidance, or a recommendation to buy, sell, or hold any security or investment. The views and opinions expressed in this report are solely those of the author(s) and do not necessarily reflect the opinions or positions of any organization or entity with which the author(s) may be affiliated.

Readers are strongly encouraged to conduct their own due diligence and consult with a qualified financial advisor before making any investment decisions. Investing involves risks, including the potential loss of principal. Past performance is not indicative of future returns, and no representation or warranty is made regarding the accuracy or completeness of any information or analysis contained within this report.

All charts, maps, drawings, and other visual representations included in this report are for illustrative purposes only and may not be accurate or drawn to scale. These visual aids are intended to provide a general understanding of the topics discussed but should not be relied upon for precise data or measurements.

It is important to note that overinterpretation of the observations and analyses presented in this report may have occurred. While every effort has been made to ensure the accuracy and reliability of the information provided, the author(s) do not assume any responsibility for errors, omissions, or any consequences arising from the use of this information. By reading this report, you acknowledge and agree that the author(s) and any affiliated entities are not liable for any direct or indirect losses, damages, or costs arising from any decisions you make based on the information provided.

Get access to our research

© 2024 Open Minds